Little Known Questions About Mileagewise - Reconstructing Mileage Logs.

Little Known Questions About Mileagewise - Reconstructing Mileage Logs.

Blog Article

All about Mileagewise - Reconstructing Mileage Logs

Table of ContentsLittle Known Questions About Mileagewise - Reconstructing Mileage Logs.Fascination About Mileagewise - Reconstructing Mileage LogsIndicators on Mileagewise - Reconstructing Mileage Logs You Need To KnowFascination About Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedThe Of Mileagewise - Reconstructing Mileage Logs

Large Bro. People living in the 21st century encounter an extraordinary recognition of means they can be kept an eye on by powerful organizations. No one wants their manager included to that listing.(https://triberr.com/mi1eagewise)In 2019, mBurse evaluated mobile workers about GPS tracking and located that 81% would certainly support their employer tracking their organization gas mileage if it implied receiving full repayment of automobile expenditures. On the whole, while some staff members reveal concerns about micromanagement and being tracked after hours, those that have actually been tracked discover those problems greatly reduced.

In order to realize the advantages of GPS mileage logs without driving workers out the door, it is essential to select an ideal GPS application and institute standards for ideal use. Drivers must have the ability to modify trips and designate specific sections as personal so that no data about these trips will be sent out to the company.

About Mileagewise - Reconstructing Mileage Logs

Drivers should additionally have the ability to transform off the app if needed. Even if you have information on your employees' location throughout organization traveling does not suggest you have to have a conversation about every information - mileage log. The primary purpose of the GPS application is to give accurate mileage tracking for compensation and tax obligation purposes

It is standard for the majority of companies to monitor workers' use of the web on firm tools. The simple truth of keeping track of discourages ineffective internet use with no micromanagement.

There's no denying there are a number of advantages to tracking mileage for business. Unless you're tracking mileage for settlement purposes, functioning out just how to track gas mileage for job trips may not feel like a critical job.

More About Mileagewise - Reconstructing Mileage Logs

The appeal of digital monitoring is that whatever is videotaped. In enhancement to maximizing your tax reductions by providing trip details and timestamps with pinpoint precision, you can remove detours and unauthorized individual journeys to improve employee liability and productivity. Trying to find a comprehensive option to assist manage your organization costs? We can help! At Roll, we understand that remaining on top of administrative tasks can be challenging.

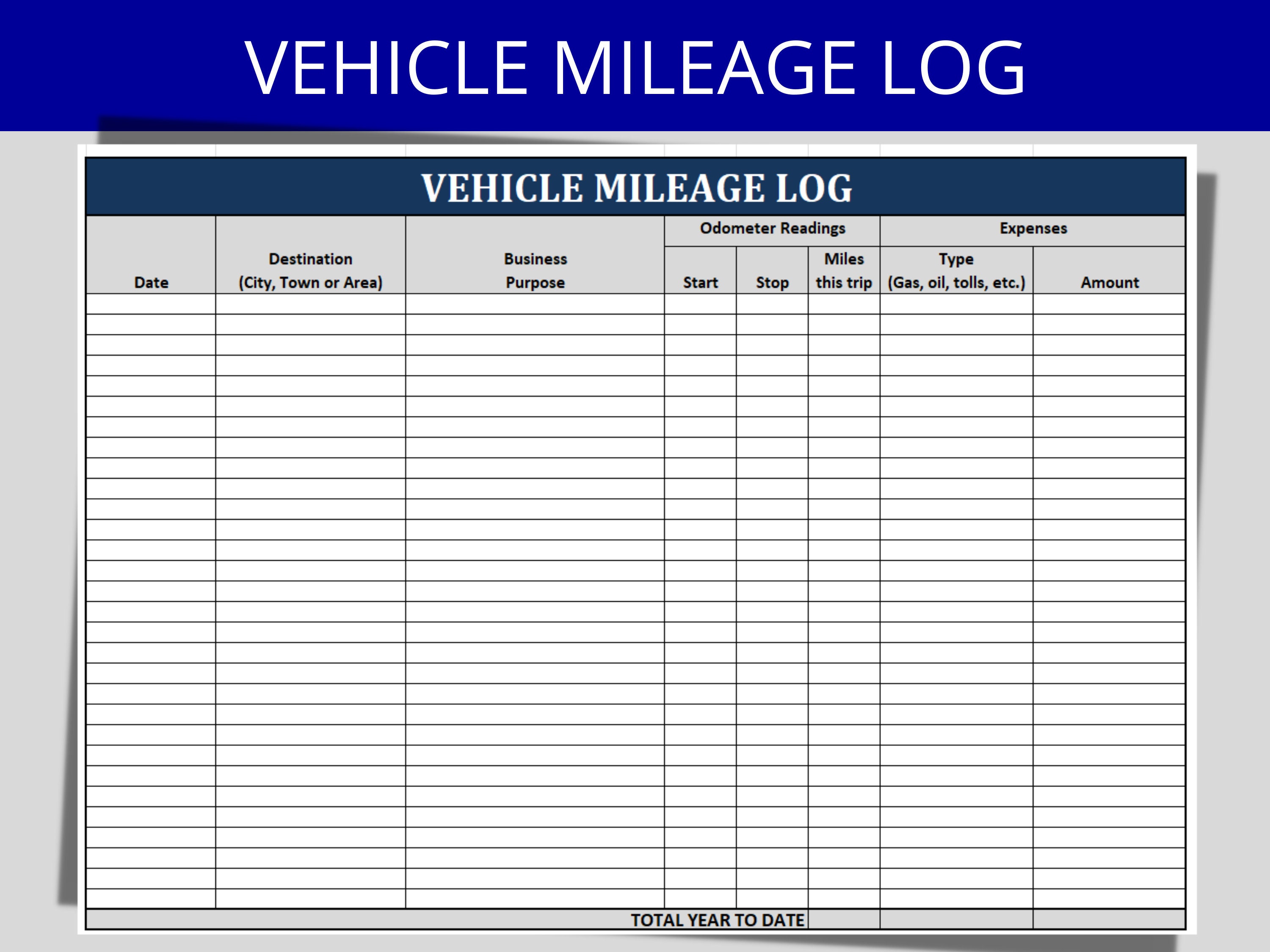

Have you experienced the pain of going over the business journeys carefully? The complete miles you drove, the fuel sets you back with n number of other expenses., over and over. Typically, it takes virtually 20 hours annually for a single individual to visit their mile logs and other costs.

The 5-Minute Rule for Mileagewise - Reconstructing Mileage Logs

Now comes the main image, tax deduction with gas mileage tracker is the talk of the area. best mileage tracker app. In information listed below, we have actually discussed the two means by which you can claim tax- deduction for the business miles took a trip.

For your convenience, we have created the listing of criteria to be considered while choosing the appropriate gas mileage monitoring app. Automation being a vital aspect in any organization, make certain to select one that has automated types which can calculate costs promptly. Always look for extra attributes provided, such as the amount of time one has worked as in the most up to date apps.

Getting My Mileagewise - Reconstructing Mileage Logs To Work

The information is constantly available to you on your mobile phone to assess, revise and edit at any time. These apps are user-friendly and simple to make use of. They help you save time by calculating your mileage and maintaining a document of your data. Therefore, Gas mileage tracker apps like Merely Automobile aid not only maintaining the mile logs however also with the repayment of organization miles.

The Of Mileagewise - Reconstructing Mileage Logs

government agency liable for the collection of tax obligations and enforcement of tax obligation legislations. Developed in right here 1862 by Head Of State Abraham Lincoln, the company controls under the authority of the United States Division of the Treasury, with its main function comprising the collection of individual revenue tax obligations and work tax obligations.

Apple iOS: 4.8/ Google Play: 3.5 Stride is a free gas mileage and expense-tracking app that deals with Stride's other solutions, like wellness insurance and tax-prep support. In enhancement to offering websites to Stride's other items, it offers a gas mileage and expense-tracking feature. I was able to download and install and mount the application easily and rapidly with both my apple iphone and a Galaxy Android tablet.

While the premium application uses to link to your bank or charge account to simplify expensing, it will not connect to your Uber/Lyft accounts. My (limited) testing of Everlance showed really similar gas mileages to Google Maps, so precision ought to be on par with the remainder of the apps. free mileage tracker app. On the whole, I thought Everlance was well-executed and simple to make use of, however the functions of the free and also exceptional variations simply really did not determine up to several of the other applications'

Report this page